Anyone who has worked with endowment spending knows one thing to be true: there are as many ways to apply a spending policy as there are non-profit institutions. With practices related to spending varying so widely, it’s almost impossible to determine what is an industry “best practice.”

Let’s leave aside actual spending calculations (we’ll save the Yale Method for another day) and explore the concepts of applying either a time/date bound restriction or an amount bound restriction on spending. In Fundriver Balance, we call these “Authorize Dates” and “Reinvest Thresholds.” I’ll define each of these terms below.

*Pro tip: keep this glossary handy

Authorize Date: An endowment fund has a date it must pass before it is allowed to spend. For example, a fund is not allowed to spend for a year after it is created. Until that date is reached, Balance clients can choose one of two options: to have no distribution calculated or posted to the Fund or to have the distribution calculated, posted, and reinvested to show an audit trail. The net impact to the fund would be $0.

Reinvest Threshold: An endowment fund must exceed a certain amount, either in market value or corpus, before it is allowed to spend. Until it meets this threshold, the same options as described above for Authorize Date are applied.

Why would funds have these rules applied?

Many institutions have a board policy that governs the minimum amount needed to establish an endowed fund. Let’s say that amount is $25,000. If an endowed gift is being paid by pledge or doesn’t quite reach the minimum, but the intent of the donor is for the fund to be endowed, it may be established but is ineligible to spend. The amount that would have been distributed from the fund can be reinvested in the fund, which will grow the fund’s value until pledge payments push it over the minimum and make it eligible to spend.

Some institutions may also require an endowment to be part of the pool for a certain time period (one year is a common choice) before it is eligible for spending.

Organizational policy can drive the addition of spending date and amount clauses on their funds, but it is not uncommon for donors to request these types of rules be applied as well (if the organization will allow them).

How do other places do it?

At Fundriver, our endowment experts are no stranger to the question “how do other organizations do it?” when it comes to spending. Let’s look at some data showing how our Fundriver Balance clients, who have anywhere from 1 fund to 22,000, apply these rules. There were 659 databases analyzed for this article.

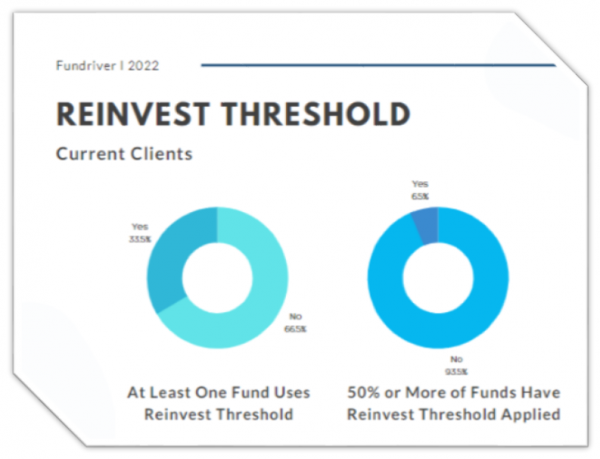

Reinvest Threshold is used by about a third of Fundriver Balance clients. For those who use it, the thresholds appear to be applied sporadically vs. across the board, with only 6.5% of institutions using a Reinvest Threshold parameter on more than half their funds.

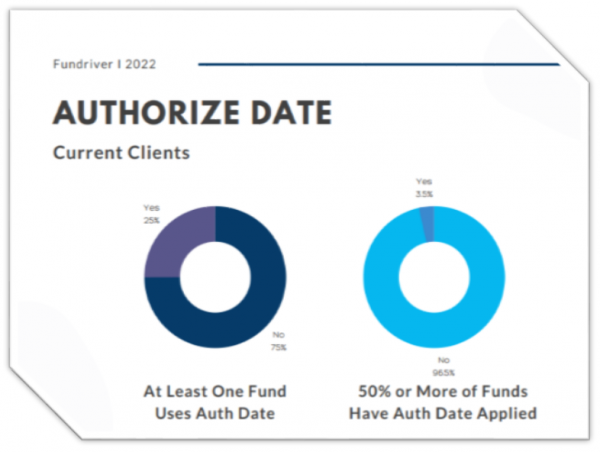

Authorize Date is used in only a quarter of Balance client databases and is applied to a minority of funds in most cases. One can presume, from the lack of consistency across funds, that most organizations have donors applying these stipulations (vs. an institutional policy).

Please note that policies change over time, so institutional parameters applied to newly created funds may differ from how the same organization treated funds 5, 10 or 20 years ago. These changes may account for why it appears that only a handful of Fundriver Balance clients apply Reinvest Thresholds and Authorized Dates “across the board.”

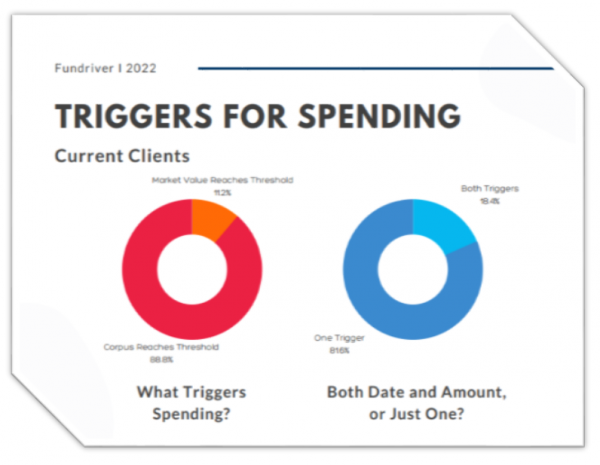

For those organizations who use these rules, most rely on the fund’s corpus value reaching the Reinvest Threshold amount to trigger distributions, with only 11.2% of institutions basing the trigger on market value.

Some funds may have both a date and an amount parameter applied, although this is uncommon. In Fundriver Balance it is possible to choose exactly how the rules process. Does meeting one of the criteria trigger spending, or does a fund need to satisfy both? As you can see, one trigger is the most common, at least with our client base.

Putting restrictions on spending based on a date or minimum amount is fairly standard, with 41% of Fundriver Balance databases using at least one of those parameters at the fund level. Fundriver Balance clients represent a range of non-profit types, including higher education, private independent schools, hospitals, museums, community organizations, and religious institutions, among others.

To learn more about Fundriver client spending statistics, check out this previous blog article.